Decoding The Balanced Budget Act: Insights & Impact | Explained

Can a nation truly legislate its way to fiscal responsibility? The Balanced Budget and Emergency Deficit Control Act of 1985, a landmark piece of legislation, attempted precisely that, aiming to reshape the financial landscape of the United States and confront a burgeoning national debt that seemed poised to spiral out of control.

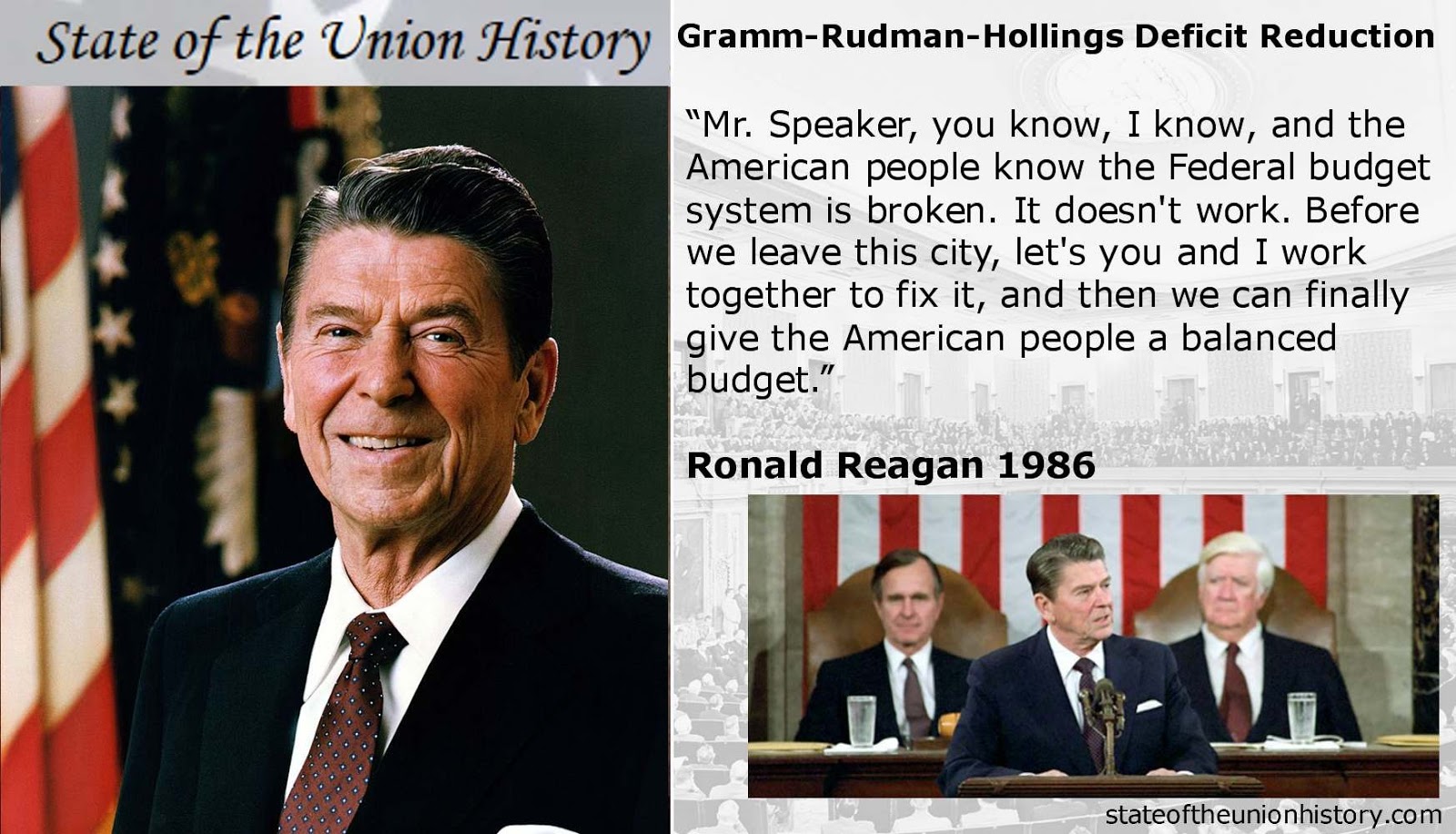

The United States in the mid-1980s was grappling with a significant fiscal challenge. The federal budget deficit, the gap between the government's spending and its revenue, had reached unprecedented levels. This situation prompted widespread concern among policymakers, economists, and the public. It was against this backdrop of mounting debt and growing anxiety that the Balanced Budget and Emergency Deficit Control Act of 1985, often referred to as the Gramm-Rudman-Hollings Act, was conceived and ultimately enacted. The Act, signed into law by President Ronald Reagan on December 12, 1985, represented a bold attempt to mandate fiscal discipline and steer the nation toward a balanced budget. The core objective of the Act was to reduce the federal budget deficit in a phased manner, with the ultimate goal of achieving a balanced budget by 1991. This ambitious target reflected the urgency with which policymakers viewed the need to address the nation's financial woes.

The architects of the Act, Senators Phil Gramm of Texas and Warren Rudman of New Hampshire, along with Senator Ernest Hollings of South Carolina, were driven by a shared sense of urgency. They believed that the unchecked growth of the federal deficit posed a serious threat to the nation's economic stability. The legislation's passage, marked by bipartisan support, underscored the seriousness of the situation and the widespread recognition of the need for action. The Acts impact would be felt across the political spectrum, prompting significant debates about its merits and consequences.

At its heart, the Gramm-Rudman-Hollings Act sought to impose a series of mandatory spending cuts if the president and Congress failed to meet specific deficit reduction targets. These targets were predetermined and designed to become progressively more stringent over time. This mechanism, known as "sequestration," was a crucial element of the Act, providing an automatic trigger for expenditure reductions if the established fiscal goals were not achieved through the regular budget process. The threat of sequestration was intended to incentivize both the executive and legislative branches to reach agreements on deficit reduction, thereby ensuring that the nation remained on track to meet its budgetary objectives.

The Act's approach represented a significant departure from traditional approaches to budgeting and fiscal policy. Instead of relying solely on the voluntary cooperation of Congress and the President, the Gramm-Rudman-Hollings Act introduced a system of mandatory cuts and pre-defined targets, which was designed to constrain spending and force a reduction in the deficit. This novel strategy sparked considerable debate, with proponents arguing that it was necessary to break the cycle of inaction and fiscal irresponsibility. Critics, on the other hand, raised concerns about the potential for arbitrary cuts and the limitations on the government's ability to respond to unforeseen economic events. These debates became central to the ongoing discussion about the Acts effectiveness and long-term implications.

The Act's implementation was not without its challenges. The pre-determined targets and automatic spending cuts, while designed to ensure fiscal discipline, sometimes proved difficult to manage in practice. There were legal challenges to the Act's constitutionality, and amendments and extensions were made to modify its provisions over time. The Budget Enforcement Act (BEA) of 1990, for instance, significantly altered the mechanisms of the Gramm-Rudman-Hollings Act, introducing new tools and procedures for managing the budget. Despite these adjustments, the underlying goal of deficit reduction remained a key focus of fiscal policy.

The Act's legacy is complex. While it played a role in curbing the growth of the deficit during certain periods, it also faced criticism for its rigidity and its potential to lead to cuts in vital government programs. The sequestration mechanisms eventually expired or became ineffective. The Act's influence on subsequent legislation, particularly the Budget Enforcement Act of 1990, highlights its significance in shaping the evolution of U.S. fiscal policy. Its introduction undeniably marked a significant effort by the federal government to curb the growing budget deficit and establish a path towards a balanced budget. Even with its flaws and alterations, the Gramm-Rudman-Hollings Act provided a roadmap for tackling the nation's economic challenges.

The central aim of the Act was to reduce the escalating federal budget deficit. This deficit represents the shortfall when the federal government's expenses surpass its revenues in any given year, a situation that had reached historically high levels during the period. The architects of the Act understood that uncontrolled deficits could lead to increased interest rates, decreased investment, and a weakening of the nation's economic foundation. The legislation's focus on fiscal responsibility was a reaction to these dangers. The intention was to prevent further expansion of the debt and encourage a more stable financial future for the country.

The mechanism of sequestration, a core component of the Act, played a vital role in its operation. This mechanism was devised to automatically instigate spending cuts if the president and Congress were unable to agree on budget resolutions that met the deficit reduction targets set by the Act. The threat of sequestration was a powerful motivator, intended to urge both the executive and legislative branches to collaborate in managing the budget and adhering to the fiscal goals. This unique strategy underscored the Act's intent to enforce fiscal discipline through mandatory measures, rather than depending solely on voluntary compliance.

The passage of the Balanced Budget and Emergency Deficit Control Act of 1985 signaled a dramatic shift in how the government approached budgeting and fiscal policy. It represented a move from traditional methods of voluntary cooperation towards a more structured system with defined goals and mandatory enforcement mechanisms. This new strategy generated considerable debate, with supporters claiming it was essential for correcting fiscal irresponsibility and opponents voicing concerns about possible arbitrary cuts. These discussions illuminated the deep-seated disagreements over the government's role in the economy and the best strategies for managing national finances.

One of the significant amendments to the original Act came with the Budget Enforcement Act (BEA) of 1990. This modification updated the tools and procedures for budget management. The BEA introduced "pay-as-you-go" rules for new legislation, mandating that any new laws that increased spending or reduced revenue had to be offset by corresponding cuts or increases elsewhere in the budget. While the fundamental goal of deficit reduction continued, these amendments demonstrated that even with the primary focus of the original Act, there was a recognition of the need to adapt to changing economic circumstances and political realities.

The Gramm-Rudman-Hollings Act was spurred by deep-seated worries about the rising federal budget deficit. The large and growing gap between government spending and revenue sparked concern among policymakers, economists, and the public. The Act's primary aim was to correct this situation. The proponents of the Act viewed deficit reduction as crucial for maintaining economic stability, controlling inflation, and ensuring the long-term financial health of the nation. Their commitment to this objective drove the legislative process, leading to the development and enactment of this significant piece of legislation.

The popular name of the 1985 balanced budget and emergency deficit control act is derived from its sponsors at the time: Senators Phil Gramm of Texas, Warren Rudman of New Hampshire, and Ernest Hollings of South Carolina. Their sponsorship of the legislation highlighted their dedication to fiscal responsibility and their efforts to address the nation's growing debt. The acts name, directly linked to its sponsors, serves as a reminder of the individuals who drove the legislative effort and shaped the direction of fiscal policy.

The signing of the Balanced Budget and Emergency Deficit Control Act of 1985 by President Ronald Reagan on December 12, 1985, marked a significant moment in U.S. history. The President's approval underscored the widespread recognition of the need to tackle the budget deficit. The enactment of the Act served as a concrete step towards establishing fiscal discipline and set the stage for significant policy adjustments and continuing discussions on fiscal management. It also emphasized the government's commitment to reducing the national debt.

The Act's implementation highlighted the inherent complexities of governing, the challenges of fiscal management, and the ongoing need for careful and thoughtful policy design. While the Act included mechanisms for automatic spending cuts, the process required ongoing adjustments and revisions, including amendments like the Budget Enforcement Act of 1990. These changes underscored the dynamic nature of fiscal policy and the necessity of adapting to changing economic conditions. It also demonstrated the enduring importance of the Act as a foundational document in the ongoing pursuit of a balanced federal budget and responsible financial management.

The act represents a departure from traditional approaches to budgeting and fiscal policy by introducing mandatory spending cuts and pre-defined targets. This departure was met with diverse reactions. Supporters argued the necessity of breaking cycles of inaction and fiscal irresponsibility, while critics were wary of the potential for arbitrary cuts. The merits of the new approach have been widely debated, reflecting the complex issues involved in financial management and the significance of these decisions for the economic well-being of the nation.

The Gramm-Rudman-Hollings Act served as a central piece of legislation in the United States' efforts to manage its fiscal policy. The Act also served as an inspiration for other government regulations, especially the Budget Enforcement Act of 1990. The goal of the Act to balance the budget by 1991 and prevent fiscal issues was central to its purpose, and the legislation ultimately demonstrated the dynamic nature of fiscal policy and the continuing need for adjusting to economic events and political realities.

The Budget Enforcement Act (BEA) of 1990, an important amendment, introduced several new tools and procedures for managing the budget. The most significant of these was the introduction of "pay-as-you-go" rules, which mandated that any new legislation that increased spending or reduced revenue had to be offset by corresponding cuts or increases elsewhere in the budget. This addition reinforced the commitment to fiscal discipline and provided a mechanism for preventing the exacerbation of the budget deficit. The changes in the BEA illustrated the dynamic nature of fiscal policy and the necessity of adapting to changing economic circumstances and political realities.

The impact of the Gramm-Rudman-Hollings Act extends beyond its immediate provisions. By attempting to legislate fiscal responsibility, it shaped the public discourse on budget deficits and the role of government in managing the economy. The Act sparked debates about the ideal balance between government spending and revenue, the effectiveness of different policy instruments, and the long-term implications of fiscal decisions. The Act prompted reflection on the complex challenges of government budgeting and helped to define the direction of US fiscal policy for decades to come.

The 1990 agreement is famous for the tax increases that forced Bush to go back on his campaign

The law provided for automatic spending cuts to take effect if the president and congress failed to reach. Its introduction marked a significant effort by the federal government to curb the growing budget deficit and establish a path towards a balanced budget. While congress was already using the congressional budget resolution as a